Very Strong Q4 Earnings from Garmin

Very Strong Q4 Earnings from Garmin

Garmin has just announced its Q4.2024 results, which are strong in many places.

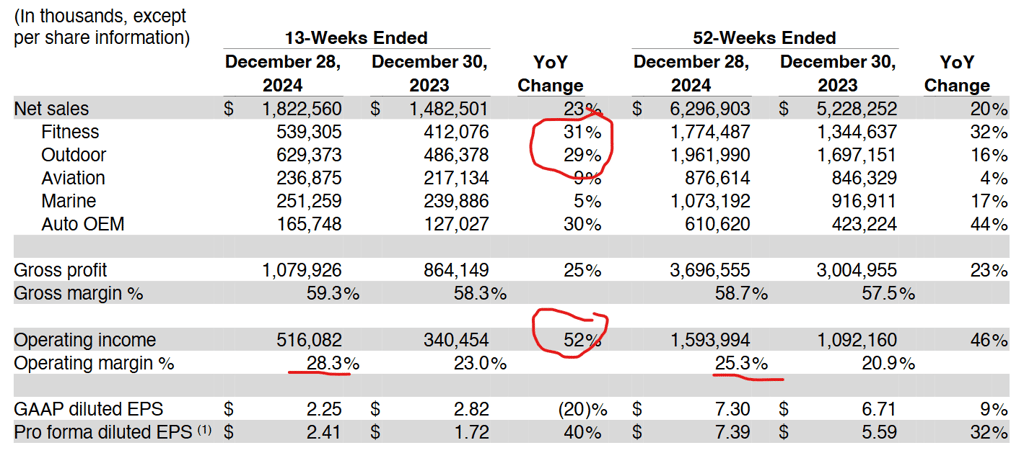

Record consolidated revenue of $6.30 billion, a 20% increase compared to the prior year

Of particular note to regular readers of this blog, Fitness (Forerunner, Edge) and Outdoor (Fenix) each had about 30% growth compared to the same quarter in the prior year. There was a similar picture for the fitness division for the entire year, but less for the outdoor division.

Fitness:

Revenue from the fitness segment increased 31% …During the quarter, we launched Lily 2 Active…We also recently released

our 2024 Connect Fitness Report.

Outdoor:

Revenue from the outdoor segment increased 29% in the fourth quarter with growth led by adventure watches.

…we launched the Approach R50…also launched the Descent X50i.

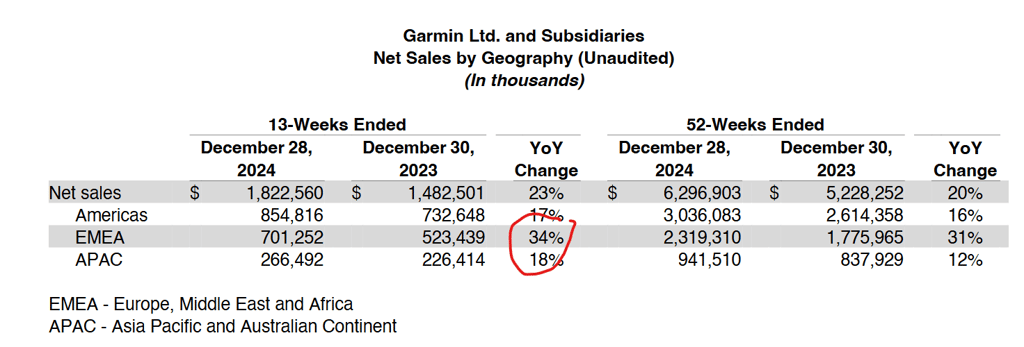

Looking at the various regional pictures, any growth of 15-20% must be good, but the EMEA region posted over 30% growth – from memory, that was based on somewhat depressed figures from the prior period.

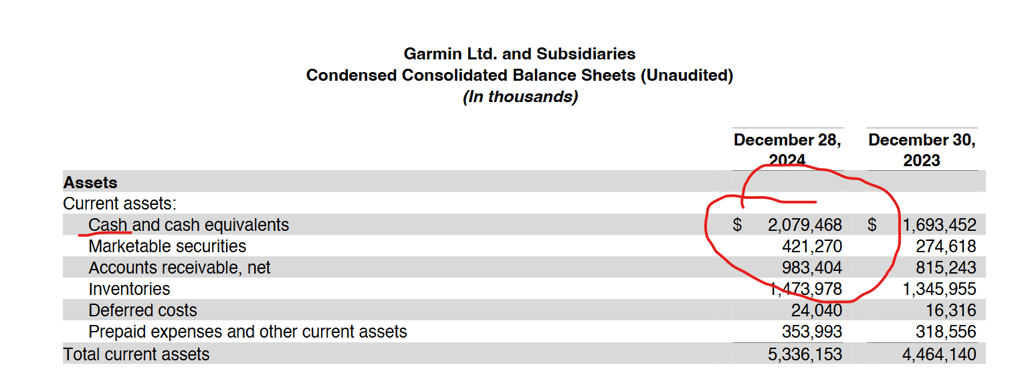

I commented on the cash position 3 months ago. Still, it’s worth saying again that Garmin has $2bn of cash—enough to weather almost any economic storm.

Against Expectations

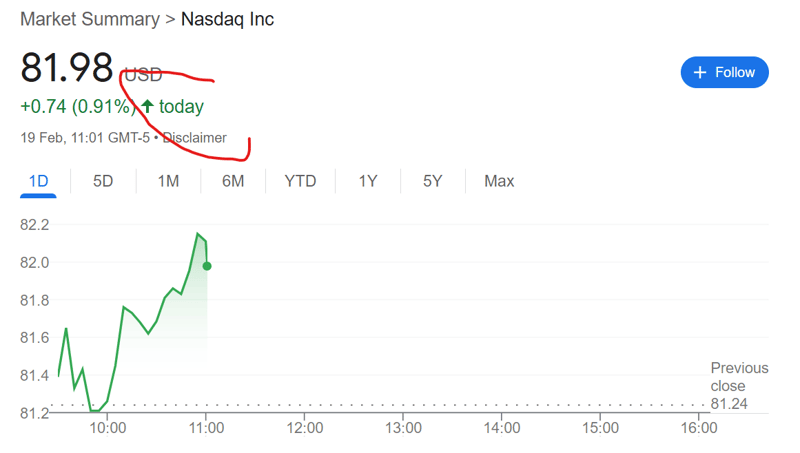

Good growth is one thing, but it only affects the share price if it differs from expectations.

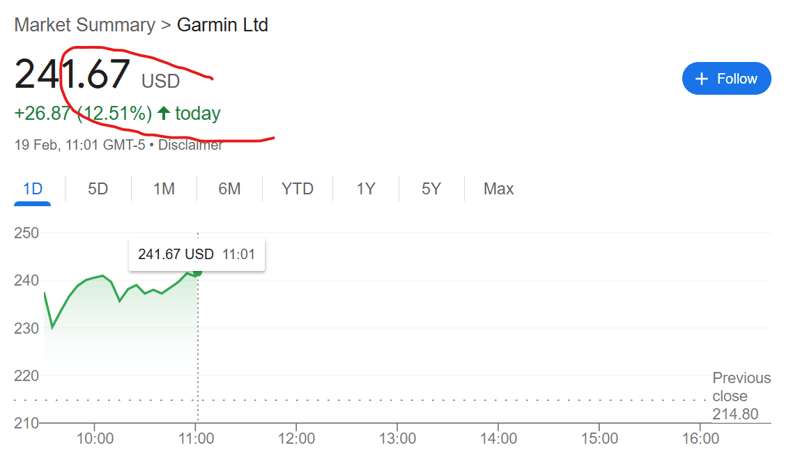

These results were better than the consensus expectations, with today’s share price growth FAR outstripping growth in the NASDAQ, which is probably a better comparator than the NYSE, where Garmin is listed.

Take Out

Blimey. That was good.

Looking ahead to 2025. We expect several significant product launches (FR975, FR275, Fenix 8 Pro, Edge 850), iterating previous models, new niche products (Varia vision), and new technologies (MicroLED), potentially adding interesting revenue streams.

Seeing how things will stack up on the demand side is always tricky as living standards continue to be squeezed. I guess the hope on the near horizon at the macro level would be a Trump-led resolution of the uncertainty around Ukraine, of course, that doesn’t negate other serious geopolitical risks elsewhere.

Garmin Growth surprises the Market – Q3.2024 Earnings results are in.

Last Updated on 26 January 2026 by the5krunner

tfk is the founder and author of the5krunner, an independent endurance sports technology publication. With 20 years of hands-on testing of GPS watches and wearables, and competing in triathlons at an international age-group level, tfk provides in-depth expert analysis of fitness technology for serious athletes and endurance sport competitors.

I thought there was a risk that Garmin would be eaten alive by Apple. Apple has 20 times the cash reserves of Garmin. Also, Apple’s business model is based on simplicity and making those few devices work really well. Garmin by contrast has to keep hundreds more watches and SKUs up to date.

Fortunately, it turns out I was wrong, at least so far. It’s impressive that Garmin continues to match or exceed Apple’s gross margin. Perhaps people don’t all want to look like clones and the variety of Garmin is appealing after all.

Now if only Garmin would add LTE functionality…

anecdotally i’ve seen more people out running in the last few years. maybe there are more people buying the garmins or it would be interesting to understand if the bump in sales came from an upgrade cycle. guess we’ll never know on the latter