How Sino-U.S. Tariffs Could Hurt Garmin

How Sino-U.S. Tariffs Could Hurt Garmin

Garmin may assemble many of its best-selling wearables in Taiwan, but its supply chain is more complicated — and has potentially just got a whole lot more expensive.

Despite confirming the final assembly for most wearables to Taiwan years ago to avoid China-specific trade risks (2018-2019), Garmin still depends on critical Chinese components such as display panels, lithium battery cells, and sensors. Let’s examine what difference that makes, if any.

Edit: As of 14 April, Smartwatches

Context

Broadly speaking, if the US increases every import tariff by 10%, it will result in a 0.5% increase in inflation.

Broadly speaking, economists like John H. Cochrane would point out that we should look at the square of the difference of the actual tariff to the equilibrium to determine its negative impact.

If you have heard recent news, we are talking about higher tariffs than the current general level of 10% and likely high levels of disruption. Remember that even in a worst-case scenario, Garmin has $ 2 billion of cash in the bank. That’s enough to weather just about any economic storm.

In the specific case of Taiwan. US tariffs on products originating in Taiwan last week were 32% (now paused) and now at 10%. But this does NOT mean retail prices would have increased by 32%. There are mitigating factors, such as the cost being applied to the import cost, not the retail price. Garmin could choose to absorb the cost.

Broad Strategic Impact of Tariffs

Here’s a table summarizing the strategic impacts of tariffs on businesses like Garmin

| Area | Impact of Tariffs |

|---|---|

| Manufacturing Cost | Increases due to effective higher costs of imported components. |

| Consumer Price | typically rise as businesses pass on portions of increased costs to consumers, tightening margins. |

| Supply Chain | Encourages reconfiguration and diversification to mitigate risks – alternative suppliers or production locations. |

| Competitive Position | Increased production costs and price competitiveness issues weaken low-margin or high-volume segments. |

| Long-Term Strategy | Incentivizes production shifts (reshoring) to avoid tariffs. |

The Risk: Tariffs Without a “Made in China” Label

US trade law increasingly focuses on the origin of component value, not just where final assembly happens.

Take a simple example. You assemble a watch in country X made entirely of Chinese components and then ship them to the USA to avoid the import taxes of over 100%.

That sort of thing happened in recent years when Chinese-origin goods went via Vietnam. Laws are now tighter, and that’s why that mysteriously uninhabited Penguin Island had taxes slapped on it,+ i.e. to stop transhipment and tax avoidance (Heard & Macdonald Islands, The Guardian).

So Garmin goods have a final assembly in Taiwan, but are they classed as Made In China or Made in Taiwan for tariff purposes, and how is that determined? A: Unsurprisingly, these matters have already been decided in law. Look at US Customs and Border Protection (CBP) rulings for sports watches, particularly ruling HQ H322417.

To save you time Googling, Garmin’s watches are deemed to be manufactured in the country where the PCBA is manufactured, Taiwan.

That means Garmin’s cost base has risen, but perhaps not as much as you’d think.

Recalculating: What Tariffs Might Add to Each Watch

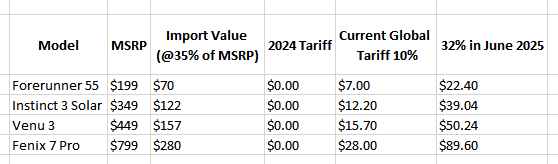

This table gives a crude indication of the tariff impact on various Garmin models. It will likely be less for Venu 3 and less for Fenix 7 Pro.

Things to bear in mind

- Products already in warehouses inside the USA are tariff-free. This only applies to future imports.

- These tariffs only apply to shipping to the USA. Thus, Garmin sales to the EU and UK can ship blissfully tariff-free from Taiwan directly to Rotterdam. Not all of Garmin’s cost base is impacted by tariffs – about 40% of Garmin’s sales are in the USA. So, the bottom line absolute impact is approximately halved.

What Will Garmin Do?

A $450 Garmin watch might need to retail at $470 to stay at historic profit levels – but only in the USA

Garmin will not act in isolation with increases driven by the decisions of its accountants. The changing competitive landscape is a significant factor, and Garmin will be acutely aware of the impact of market share should it raise its prices. It will also be mindful that tariffs will adversely impact its competitors.

Garmin faces a three-way decision:

- Absorb the costs — which eats into margins and shareholder value. This is unlikely except over time frames of a few months. Garmin is heavily focused on delivering certain performance margins to its shareholders.

- Raise retail prices — risking market share in a fiercely competitive segment. Garmin will likely match price rises of cheaper products to maintain market share. Still, it may disproportionately raise the prices of its more expensive goods where there is little competition, locking in higher margins.

- Redesign supply chain – to reduce dependence on overseas assembly. That decision cannot be made until there is certainty – a 10% Taiwan assembly tariff might be bearable. Still, 32% tariffs would favour relocating some assembly to the USA in a factory completed in 3 years, made with Chinese components tariffed at over 100% and with US skills that don’t exist in abundance (hmmm).

Can Garmin Adapt?

What is Garmin adapting to?

The only adaptation we will see in 2025 is price adaptation. But it is unclear what will happen elsewhere and, thus, what to react to.

Sales of smartwatches market will almost certainly fall overall if there is a recession; competitors might go out of business if tariffs persist. Price inelasticity exists at the high end of Garmin’s product ranges. We will probably see rises there.

Cheaper products are more price-elastic, so we are likely only to see price rises that match the competition. If the competition goes out of business, there might even be price rises.

Bottom line: It’s a confusingly dynamic situation, but don’t expect price cuts in the USA!

Big Picture: More Than Just Garmin

Garmin isn’t alone — Apple, Fitbit, Coros and others face similar, perhaps worse, pressures – maybe even existential threats for the likes of Coros.

Consumers won’t see the tariff impacts tomorrow, but the effect will creep in through:

- Higher prices

- Fewer model refreshes

- Slower innovation cycles

Final Thought

This isn’t about politics. It’s about economics catching up with geography.

Garmin built a resilient supply chain that did not expect 32% on its final assembly partner. As of 14 April that higher rate is paused.

There is a high degree of certainty that prices will rise, but the timing and degree to which they rise is unknown.

Buy your Garmin now. Not later.

Last Updated on 26 January 2026 by the5krunner

tfk is the founder and author of the5krunner, an independent endurance sports technology publication. With 20 years of hands-on testing of GPS watches and wearables, and competing in triathlons at an international age-group level, tfk provides in-depth expert analysis of fitness technology for serious athletes and endurance sport competitors.

I am going to sell my garmin. I only need good sleep tracking watch and see HRV like in https://www.mysasy.com ..

It’s chaos. The “reciprocal” tariffs are “paused” for 90 days but the 10% rise on everyone — even penguins — is in effect. But electronics from China are now exempted. But China has halted exports of rare earth minerals. Chaos.

The penguins are livid.

all chinese electronics are not exempted. Only some, which includes iPhones

It’s a pretty broad set of things that are categorized as automated data processing machines, integrated circuits, flat screen displays and touch screen displays, all kinds of diodes, transistors, semiconductors and other components. These are not just exempted from China but any origin.

This is, of course, temporary because that is good for business planning and whatnot.

It is kinda gobbledygook but you can look it up here.

My understanding is that smart watches that communicate with phones are classified under 8517.62.00, which (if correct) means all smart watches are exempted for now.

https://content.govdelivery.com/bulletins/gd/USDHSCBP-3db9e55

https://hts.usitc.gov/

I think this ruling for Apple Watch is probably generally applicable.

https://rulings.cbp.gov/ruling/H260060

HOLDING:

By application of GRI 3(b), the Apple Watch wearable electronic device is classified in heading 8517, HTSUS. Specifically, it is classified in subheading 8517.62.00, HTSUS, which provides for, “Telephone sets, including telephones for cellular networks or for other wireless networks; other apparatus for the transmission or reception of voice, images or other data, including apparatus for communication in a wired or wireless network (such as a local or wide area network), other than transmission or reception apparatus of heading 8443, 8525, 8527 or 8528; parts thereof: Other apparatus for transmission or reception of voice, images or other data, including apparatus for communication in a wired or wireless network (such as a local or wide area network): Machines for the reception, conversion and transmission or regeneration of voice, images or other data, including switching and routing apparatus.” The 2015 column one, general rate of duty for merchandise of subheading 8517.62.00, HTSUS, is free.

yep, thank you

Of course the reprieve is apparently temporary. Mr Trump and Mr Lutnik are making statements that some kind of tariff on these items will come into effect. Easy to make plans. Clear as mud.