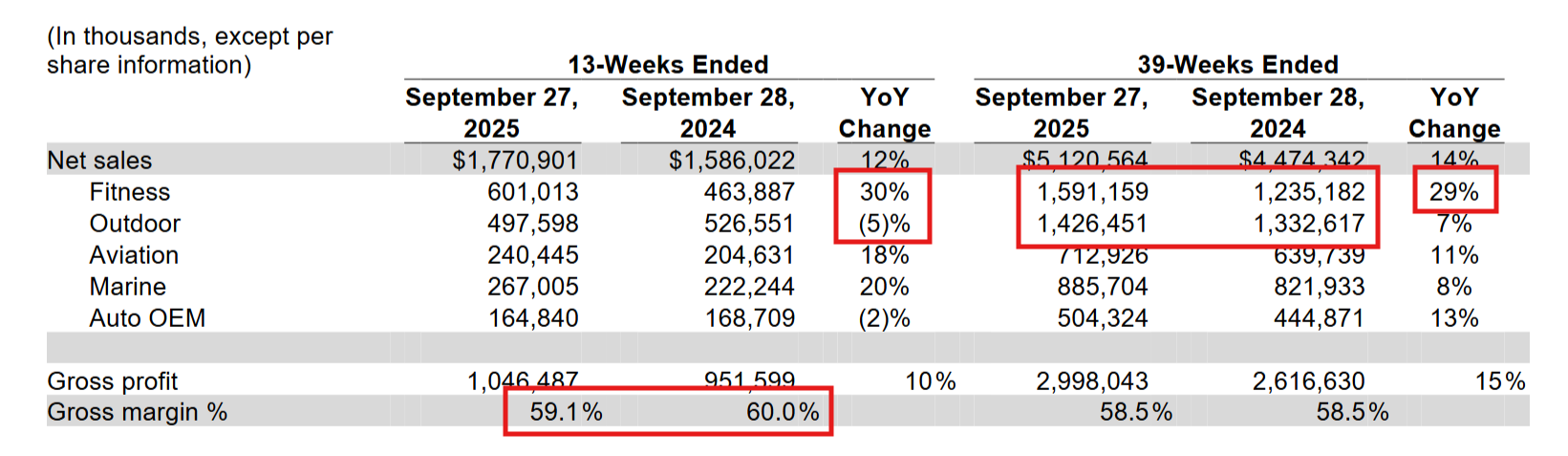

The Gen Z Effect: Garmin Fitness Overtakes Fenix as Sales Lead Increases to $165M

The latest quarterly stats from Garmin show the company’s record sales. Of particular note is the positive performance of the Fitness division (Forerunner, Edge), now confirmed as the largest division in Garmin. The Fitness division has extended its dominance over Outdoor in the previous quarter to the full 2025 calendar year – i.e. when the nine months of sales are cumulatively considered, the Fitness division has sales of $165m higher than the Outdoor (Fenix) division.

Analysis:

This is not a tech story. By looking at Garmin’s sales, we see a proxy for changes in aggregate customer behaviour that all companies in the sector should endeavour to understand.

The all-conquering Fenix appears to have stopped conquering, at least regarding Garmin’s internal finances. The Outdoor division has long been the company’s sales leader, probably fundamentally supporting multiple customer segments pursuing an active outdoors experience-led lifestyle.

2025 might mark the turning point where a new wave of Gen Z takes different kinds of fitness more seriously.

Perhaps not shackled by the need for expensive alcoholic-fuelled nights, a mortgage debt and possessing an urge for a healthy lifestyle, Gen Z are donning their running shoes…and Garmin Forerunners.

Considering this customer trend more widely, I expect all brands to benefit somewhat.

The Competitor Question

Considering this Gen Z-driven trend more widely, all brands, from Google, Apple, and Samsung to Polar, Coros, and Suunto, stand to benefit. However, the youth segment’s primary device is the smartphone, raising the age-old question: can a dedicated sports watch compete with a budget-friendly, ‘two birds with one stone’ smartwatch that fulfils a basic fitness need and simultaneously improves the smartphone experience? The budget challenger brands like Amazfit only amplify this challenge in terms of cost.

Take Out

Looking broadly to future changes, Garmin Forerunner watches and its fitness division are very well placed to capitalise and adapt to the market changes we now see.

Last Updated on 26 January 2026 by the5krunner

tfk is the founder and author of the5krunner, an independent endurance sports technology publication. With 20 years of hands-on testing of GPS watches and wearables, and competing in triathlons at an international age-group level, tfk provides in-depth expert analysis of fitness technology for serious athletes and endurance sport competitors.

Small correction: “Garmin’s cash position weakened slightly” is incorrect. The cash position actually stayed the same – and improved by $87m when taking into account marketable securities:

Cash and cash equivalents $ 2,072,208 $ 2,079,468

Marketable securities 515,038 421,270

The table/exhibit you posted is not cash position (which is a balance sheet item) but rather for (free) cash _flow_ during the period. And even then, the decline in free cash flow is quite benign because it is mostly due to a significant (> $200m) net increase in inventories – no doubt connected to the new device launches and in order to avoid OOS situations, like noted for the FR970.

If you go to Garmin Forums and compare the comment sections of the 570 and 970, it’s staggering….either the 570 is perfect out of the box with no bugs whatsoever…or no one is buying it….I suppose the latter.

But it seems the the Sleep Index Band has been delivered to the early adopters, because the first complain are coming in…Did you get one? I wonder how much the band data will deviate from the watch data.

in the context of this artcile i dont know how garmin books its revenue

it could invoice trade buyers of Index as it ships bulk volumes

i dont plan to get one. but i might eventally. if it was designed for sport i would