Garmin 2026: New Watches, Bike Computers & Sports Tech Predictions for the Industry

V2.7.21 – 15 Feb 2026

2025 was the busiest year ever for wearable sports tech. Garmin introduced many new watches, new types of tech components, and a new product category. Usually, new product releases only last until early October – Coros Pace 4 in November and Amazfit Active Max in December- and they polished off an exceptionally hectic year.

Google and Samsung have gotten their acts together on the wearable front, and Apple has iterated its 3 key Watch versions. The former, Google, was the first company to introduce satellite connectivity on the wrist, and Garmin and Apple followed a few weeks later. Innovative tech keeps on rolling in.

Coros seems to be stabilising its market position, perhaps predictably. Still, it now faces stiff competition from lower-priced watch brands, most notably Amazfit, which has introduced a Whoop competitor and several competent watches.

Listen to the discussion

How This Article Determines Upcoming Sports Tech Models

Here, we cover all the recently released sports watches and bike computers, as well as the expected next-gen models from Garmin, Polar, Coros, Apple, Wahoo, Suunto, Samsung, Amazfit, Magene, and others.

The information here is typically based on industry discussions, dual-sourced rumours, high-quality leaks, extrapolations from past product release cycles, broader technological trends, and their availability. Almost all the new products I discuss here will happen, but precise timings and model names are not always set in stone, even at Garmin HQ. As we enter 2026, Garmin has strengthened its information security, so you can expect fewer product leaks going forward.

Note, these are my rules.

- I never include any information that violates NDAs

- I never include information from press releases once I have personally received them (effectively an NDA).

- I never publish information obtained illegally.

Regular readers know this article is frequently updated. If you’re here for the first time and interested in ‘future sports devices and feature sports tech developments,’ this post is a good read. It focuses on different aspects and discusses new technologies and features rather than specific watch models.

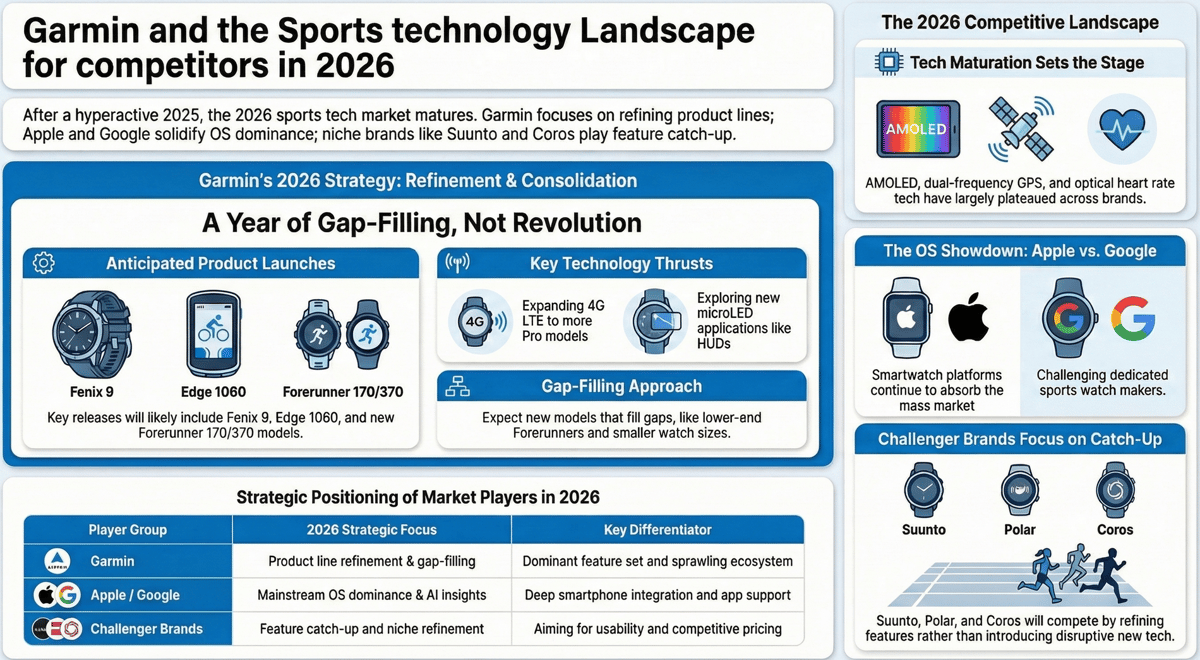

What’s Next From Garmin for 2026

2026 doesn’t look as exciting as 2025. I have added detailed thoughts below for the likelihood of every new product in 2026, but here’s an overview of what’s coming.

We will see range fillers that plug obvious gaps, such as lower-end Forerunners, smaller-case-format watches, and lower-priced Edges. But that’s not the story Garmin wants you to hear (buy). Garmin will identify technological gaps to deliver higher-end products—a good thing- with matching premium pricing.

Thus, these will be the big thrusts for 2025

- 4G LTE on more Pro models (Garmin watches are sticking with 4G LTE/LTE-M, unlike Apple moving to 5G RedCap).

- A new MARQ – will Garmin double down on microLED with more in 2026? I think MARQ is perhaps the only model that could have microLED in the near future.

- Start of the new Edge x60 series with Edge 1060.

- Enduro 4 – H2.2026 (August)

- a Varia HUD (my intel on this could have referred to the Garmin integration on the Oakley Meta Vanguard)

- a solid Whoop competitor – CIRQA (other than Polar, Amazfit…Coros?)

We won’t see any mainstream microLED models until the technology realises its long-promised energy-saving potential, which it has failed to achieve in F8 Pro. Surprisingly, we won’t see any more satellite-enabled Garmin watches, only further updates to the Fenix range. However, we might see onboard satellite capabilities on high-end handhelds, offering an alternative to handheld inReach devices.

RETROSPECTIVE: Garmin 2025 – a recap

Very briefly, here is what we had in 2025.

- Instinct 3 Series (6 January 2025), Descent G2 (12 Feb 2025), Instinct 3 TACTICAL (24 April 2025), Tactix 8: Feb 2025, Vivoactive 6: April 2025, Forerunner 970 (15-May 2025), Forerunner 570 (15-May 2025), ️Venu X1 (June 2025), Quatix 8: 25 June 2025, Venu 4 (Sep 2025), Garmin Fenix 8 Pro microLED (September 2025), Garmin Fenix 8 Pro LTE (September 2025), Rally 210/110 (Q3.2025), Instinct Crossover (Instinct 3, September 2025), Bounce 2 (September 2025), Edge 850/550 (September 2025), HRM 200, ️HRM 600, Varia Vue: 8 April 2025, Garmin TACX Alpine 25 June 2025, Garmin Index Sleep Monitor (June 2025), plus various handhelds like eTrex Touch. The year ended on a high note with D2 Mach 2 (22 October 2025) and D2 Air X15 (22 October 2025).

From a product range perspective, Garmin appears to have discontinued sub-brands with a poor image (Rally RS > Rally X Series), confirmed the PRO models as an interim release between major model upgrades, and rationalised numbering conventions (x65 > 570/970).

Garmin Leaks/Launches So Far

- ✔️ Garmin Quatix 8 Pro – 13 January 2026

- Garmin Vivosmart 6 – January 2026 : vivosmart 5 (april 2022)

- Garmin CIRQA – Q1.2026 (leaked)

- Garmin Varia RearVue 820 – 3rd feb 2026

Speculated Garmin Products for 2026

It could be an exciting year for Garmin. I wouldn’t expect too much beyond what is shown here. Let me know if I’ve missed something.

The products listed as CERTAIN are strategically important to Garmin and must happen; the exact timing may be unknown.

Other extensions of existing products, like FR970, are also certain in one sense; however, the precise name of the new model or the headline new feature (LTE!) might not be certain, so I’ve marked a variety of future ways forward for these as POSSIBLE.

| Likelihood | Speculated Product | Speculated Release | Predecessor Product | Predecessor Release |

|---|---|---|---|---|

| Likely | Forerunner 170 | March 2026 | Forerunner 165 | February 2024 |

| Possible | Forerunner 370 (375) | March 2026 | Forerunner 265 | March 2023 |

| Certain | Fenix 9 | Late 2026 / Early 2027 | Fenix 8 Pro | September 2025 |

| Certain | Tactix 8 Pro | Late 2026 | Tactix 8 | February 2025 |

| ✔️ | Quatix 8 Pro | 13 January 2026 | Quatix 8 | June 2025 |

| Certain | D2 Mach 2 Pro | Late 2026 | D2 Mach 2 | October 2025 |

| Unlikley | D2 Air X15 Pro/Small/LTE | 2027 | D2 Air X15 | October 2025 |

| Possible | Forerunner 975 (LTE) | May 2026 | Forerunner 970 | May 2025 |

| Possible | Forerunner 575 (LTE) | May 2026 | Forerunner 570 | May 2025 |

| ✔️ | CIRQA – Whoop Wannabe | Q1.2026 | Index Sleep Monitor | January 2025 |

| ✔️ | Varia 820 | Feb 2026 | Varia RTL515 | May 2020 |

| Possible | Varia RVR325 | May 2026 | Varia RVR315 | May 2020 |

| Possible | Varia RCT725 (4K) | May 2026 | Varia RCT715 | May 2022 |

| Possible | HRM400 (midrange HRM200 – HRM600) | March 2026 | HRM-Dual | January 2019 |

| Possible | Tacx Neo 4 | November 2026 | Tacx Neo 3M | December 2023 |

| Likely | MARQ Gen 3 | Q3.2026 | MARQ Gen 2 | October 2022 |

| Certain | Enduro 4 | August 2026 | Enduro 3 | August 2024 |

| Certain | Descent Mk4 | October 2026 | Descent Mk3 | November 2023 |

| Certain | Edge 1060 | June 2026 | Edge 1050 | June 2024 |

| Likely | Edge Explore 3 | August 2026 | Edge Explore 2 | July 2022 |

| Possible | Varia HUD | ? | Varia Vision | January 2016 |

| Possible | Instinct 3 Pro (w/Maps, aka Instinct 4) | ? | Instinct 3 | January 2025 |

| Possible | Lily 3 | Due, no leak | Lily 2 | January 2024 |

| Possible | Venu X1 Pro (LTE) | Sep 2026 | Venu X1 | September 2025 |

| Possible | Index S3 Scale | ? | Index S2 | October 2020 |

Don’t expect to see a Garmin smart ring.

RETROSPECTIVE: The broader market – a recap

Key Trend: The latest models of key sports watches often feature AMOLED displays. Improvements to MIP screens will continue to extend the lifespan of that technology in niche scenarios, and transflective displays appear to be the choice for Garmin and Wahoo bike computers. The disappointment to top all disappointments was Garmin’s microLED Fenix. The company deserves kudos for releasing the tech, but its component supplier, AUO, failed to deliver the promised performance savings, and we ended up with battery performance degradation.

Dual-frequency, multi-constellation GNSS (dual-band GPS) chipsets are the norm, but mini generations of that technology have quietly entered use. For example, Suunto has stuck with the older, slightly less accurate Sony tech, whereas Garmin uses Synaptics, which appears superior. Garmin’s addition of 5Hz GNSS recording (first reported on this site)—more frequent recording hampered by the constraints of the FIT format—is particularly interesting to me, albeit with only edge-case uses.

Optical HR tech seems to have plateaued and refined its capabilities to a reasonable degree of accuracy. The next generation of OHR sensors capable of measuring new physiological parameters has long been promised, but it doesn’t appear imminent, even in 2026.

Sports physiology metrics have also plateaued. Sure, Garmin seems to introduce a new one every month, but the foundational innovations were established years ago and are backed by science (Oura, Eight Sleep, Polar, etc.). There are two sub-trends worth mentioning. First, some companies are playing catch-up to get metrics in place (occasionally inventing them on a whim). Secondly, there is a race to present this data coherently in the smartphone app to appeal to a mass market – Whoop exemplifies this, Garmin tries hard, and Polar (LOOP) must try harder still. Expect further innovation with ECG-grade data from chest straps during sports, 24×7 ECG monitoring (subscription), and additional novel uses of DFA a1, such as Suunto’s DDFA.

It seems we are close to a stage of maturity in both commonly used technology and the sports functionalities that watches offer.

Software/chip platforms appear to have settled, with most brands adopting high-performing tech stacks. Suunto has decided on a responsive platform, probably for the next couple of years. Garmin is said to have merged its internal software features into a single code branch, meaning features and bugs will not be replicated across different parts of the company—a good thing.

EU-driven legal changes are afoot. Whether it’s user-serviceable batteries or standard USB-C charging mechanisms, you have at least that to think about in the EU. Those are peripheral issues to the general direction of tech travel, though. More importantly, the EU seems determined to break Apple’s grip on its ringfenced smart features. Apple is not happy. However, Garmin is delighted, and if the EU gets its way, it will enable Garmin to produce far more coherent smart features that more deeply integrate with iPhone features. This is strategically significant to Garmin’s future; you cannot underestimate what is happening here.

Pricing Update from 2025

After a few years of relative price stability, companies like Suunto, Coros, and Garmin generally raise prices on replacement models.

Tariffs: The long and short of the complexities of early 2025 is that some companies are now putting prices up. American consumners are generally paying more but in niche cases are being spared the full shock by companies raising prices elsewhere to compensate.

The rises are more notable for Suunto and Coros, which benefited from low-cost models that boosted sales and raised awareness. That little game is over, and both revert to a pseudo-premium brand pricing strategy.

Onshoring, Re-shoring and de-China-ing (that is a word)

99% of all wearable sports tech is made in Asia, with a substantial portion produced in China. Some companies are trying to de-risk their operations from China for various reasons, but it isn’t easy or cheap. For example, Apple moved Watch production from China to Vietnam, at least for models destined for the USA, to mitigate tariff implications.

The 2026 Landscape for New Garmin Products

OK. This is what you came for

2026 will be a good year for Garmin lovers.

But you had too much excitement in 2025, so things will calm down a bit now. Sorry!

That said, the Fenix brand has historically followed a 12- to 18-month refresh cycle, and you can bet your bottom dollar that Garmin wants to make that yearly. There is a strong likelihood we will see a Fenix 9 in September 2026 (at the latest, Jan 2027). I’ll have to dig more to see what Fenix 9 could add. Maybe 5G Redcap, certainly satellite, maybe Elevate 6, certainly deeper smart features, hopefully an improved microLED option. None of that is a forgone conclusion.

Edge 1060 is also on my list of highlights for 2026. Garmin appears to have doubled down on the odd-case shape format (it’s even on the latest eTrex). Maybe the 1060’s display tech will be updated in a new model to be more power-efficient? (This will trickle down in 2027 to 560/860.) I’m struggling to see the next big thing in bike computer tech besides NFC payments. Bike computers seem to do all they need to.

Instinct 3, with its hybrid and AMOLED versions, is popular. We will undoubtedly see the usual raft of Surf, Camo, and other variants, none of which will have maps. I suspect that in 2027, Instinct will begin to receive a few trickle-down features from Fenix, such as maps. Perhaps there will be an Instinct Pro version with maps?

With the Forerunners, there is scope for new 170/370 model(s) sitting below the existing 570/970. We will see at least one of those. There’s also scope for smaller case sizes—I wouldn’t be surprised if Spring brings a Forerunner 970 41mm Pro LTE version. The Forerunner 2026 strategy will be gap-filling. That’s OK, though.

Various gaps will be addressed for the Fenix/Instinct variants targeting specific verticals. Thus, D2 Air X15 (Venu) and D2 Mach 2 (Fenix) have both been leaked for aviators.

On the smartwatch side, you may see a Venu X1 Pro with LTE soon.

On the indoor training side, expect a new TACX trainer or two to be released later in 2026.

For accessories, I expect the Varia radar taillights to finally get a spring refresh of the base model.

But I also expect the Varia brand to be extended once again back to a HUD, which I thought might happen in 2025 (based on concrete intel, but which may have referred to the Meta integrations)

The most straightforward cycling product to predict last year was the Edge 140, but it did not materialise and will likely be skipped, appearing as the Edge 150, only if Garmin decides to remain at the ‘low’ end of the market.

Key Trends: Unlike 2025, expect 2026 to feature new trickle-down products, with existing software and hardware features passed down from top-end to middle- and lower-end models.

Expect one new Garmin technology, such as microLED view-through panels (HUD). Expect Garmin’s naming convention to become clearer, e.g., FRx70 and Fenix E.

Garmin Forerunner for Runners & Triathletes

Thanks to the introduction of the Forerunner 165 a couple of years ago, the AMOLED transition is now complete on the running/triathlon side. As predicted here many years ago, MIP/solar has become a niche running feature; perhaps only Enduro 4 will continue to use this technology.

Here’s the current range

Currently Garmin offers: FR55 (42mm, MIP)> FR165 (43mm) > FR265/265s > FR570(42/47) > FR970 and Enduro 3 (large, MIP, Solar)

I view the FR570 as a continuation of the older 645/655 model, which we thought was discontinued. I.E., a high-end model that is pared back in some ways. This leaves the entry-level and mid-level in Garmin’s range as the next to be updated. We will likely see it transition to support two sizes and focus solely on running the two lower models. Thus, the higher-end models retain the multisport and other niche focus:

Garmin Next Stage (2026): FR170 (43mm) > FR270(42/47) > FR570(42/47) > FR970 and Enduro 3 (large, MIP, Solar)

Subsequently, Garmin will add PRO versions. I suspect these will be the FRxx5 models or existing models labelled with a Pro suffix. Incrementing model numbers by 5 rather than 10 might give Garmin a few more years with this numbering scheme, and explicitly stating the PRO name is more meaningful to consumers. This might manifest as PRO models being 4G LTE without ‘LTE’ explicitly added to the name.

Garmin Stage II (2026-27): FR170 (43mm) > FR270(42/47) > FR570(42/47)/575 > FR970 (47)/975(42) and Enduro 4/3 Pro (large, MIP, Solar)

Perhaps later we get this..

Garmin Stage III – After Stage II, I would see microLED (2027) as the next boost of tech innovation perhaps also 5G RedCap/Satellite (2027) on the very top Forerunner models once proved elsewhere.

Enduro is a Fenix MIP solar device designed for trail and ultra-runners. MIP will only be replaced if AMOLED+Solar becomes available in one panel, i.e., without a solar ring.

Adventurers

For adventurers, the Fenix 8 Pro, Fenix 8, and Fenix E are high-end products, differentiated by maps and other advanced features (Elevate 5). The Fenix models underwent iterative updates to accommodate the specific needs of niche markets, including marine, diving, aviation, driving, and military applications. It seems sensible to assume that the Instinct Range will mirror Fenix in terms of its technologies and target customer demographics.

Features and price will differentiate Instinct from Fenix. The most apparent feature omission is the MAPS and the Elevate sensor version.

Solar+AMOLED Displays (brighter screens)

Garmin secured patents for SOLAR (AM)OLED in 2022, which may be the new feature innovation for high-end watches in 2026-27, alongside 4G LTE/5G RedCap/Satellite connectivity.

In my opinion, Solar has its place only in MIP-screen watches and possibly on bike computers. The usefulness of SOLAR is limited by the fact that sufficiently long battery life is possible without solar charging. So, do we ever need solar on FENIX AMOLED watches? I think not. That said, we will see solar Fenix models despite there not being a widespread need for them.

Smart features on sports watches

Garmin’s iOS Victory – EU may force these missing smart features to be made available

Given its limited access to iPhone features, I’m unconvinced Garmin can deliver meaningful LTE features beyond those it already supports. That said, December 2023 revealed insights into the new CIQ capabilities for 2024, providing substantial clues about the upcoming headline features for new watches. They mostly hint at new 5G/LTE capabilities rather than anything else.

Garmin’s addition of high-quality microphones and speakers is solely to make its smart watches more competent. It just so happens that secondary uses are found in sports.

Connect IQ 8 (CIQ 8)- what’s announced and known about System 8 for new 2025 watches

The current Elevate Gen 5 HR sensor (2023) is a relatively recent innovation with on-demand ECG capabilities. That ECG tech will eventually be rolled out to most watch geographic markets and Product Series from now until the end of 2026, but I’m not at all excited by the prospect and suspect that much of the sports market won’t be either.

Garmin is actively including the prior-gen Elevate gen 4 sensor (Instinct) on some new, lower-end models. I expect a similar strategy to emerge if/when Elevate 6 arrives. IE, Elevate 6 and 5 would be added to new watches, with the older of the two most likely kept for second-tier devices as a differentiator.

Garmin’s wrist-based ECG is highly limited and nothing like what is offered by the 24/7 ECG on a Fourth Frontier X2 strap or, indeed, by the passive nature already provided by Apple’s Afib – Garmin lacks passive ECG and true AFib detection (it infers it), requiring a manual reading for the former. Perhaps better passive monitoring is a feature for Elevate 6?

With Whoop, Apple and Samsung offering hypertension (blood pressure) trends, Garmin will likely respond in 2025-26.

Elevate 6 needs to have blood pressure, passive ECG capabilities for resting levels of exertion, and even EMG.

Features – A quick look at emerging feature areas

Next-gen biomarker sensors

Where are the next-gen HR sensors that can sense novel biomarkers? Apple is supposedly lining up its new sensor package (it is supposedly doing many things). Is it plausible that conservative Garmin could sneak ahead of cautious Apple? It showed it could do that with microLED.

The following link discusses some of these novel biomarker sensors that were at relatively advanced stages of development in 2023, but are still not in the mass market three years later.

Next Gen Sports Sensors for 2023 and beyond – Lactate, blood pressure, hydration, creatinine

Wellness/Medical Features

Blood pressure/Hypertension TREND sensing is the current trend for the addition to watches’ sensor capabilities.

As 2025 draws close, there is an ominous silence around brands claiming FDA-approved blood pressure features. We’ve seen a few like Whoop, but the tech seems tricky to certify.

Additionally, all wearable platforms will integrate more closely with medical health record platforms—your doctor or insurer could easily access your data (with your permission).

Blood Panels

One big trend for 2025 will be Blood Panel data.

You pay for a series of tests that determine 50-100 biomarkers. Tracking these over time manually is simply a good idea in itself, and more than your regular doctor will likely offer you. Several companies are entering the market with new services in this area, and Whoop has already begun its rollout in 2025.

In my mind, this data could be exciting once correlated with your other existing biomarkers (e.g., sleep, HRV, etc.). All the smartwatch companies have the tech and data in place to do this. I’d be surprised if Garmin does not do this.

Medical Reporting

Expect to see more links between your wellness data on your app and your doctor’s practice software.

The data exchange protocols are agreed, I believe,e and so it’s only a case of your watch app and your doctor buying into the service.

Satellite/5G

As predicted here, Garmin introduced satellite connectivity to the Fenix 8 Pro. The surprises were a move from Iridium Satellites to Skylo and a failure to introduce 5G RedCap, instead sticking to 4G LTE (LTE-M).

Garmin will move PRO-grade models to 5G RedCap at some point…but it might not be 2026.

Garmin already has a feature-rich set of satellite and LTE features. Its inReach tariffs are complicated and will rationalise over time. However, the biggest drawback is that Garmin’s new non-emergency location-sharing features only work with people who use the Garmin Messenger app, which is highly restrictive.

User Repair

Google Pixel Watch 4 (2025) is the first notable smartwatch to allow owners to change the battery.

Regulation will eventually force user serviceability of watches, most likely driven by the EU (love or loathe them, they are the only region willing to legislate against powerful tech companies).

Apple will resist this, which benefits when battery degradation prompts an upgrade. This will be financially bad for Apple.

Companies: Suunto, Polar, Wahoo, Hammerhead, Coros & Other Sport-focused GPS Watches

What’s Next for Garmin’s Competitors?

-

-

- Feature catch-up to Garmin

- Fleshing out the competencies in individual feature sets

- Deeper physiology

- More refined mapping

- More true audio features using microphones and speakers rather than old-fashioned beepers.

-

Regular iterations of new hardware models with features along these lines might be exciting in a marketing sense if competitively priced.

Suunto seemed to be going down that route in 2024-25 but has since backtracked. Companies seem fixated on high-margin commercial moves supported by even more features that bring them into more direct competition with Garmin, a battle they will usually lose.

I expect no inspiring new tech moves for the Challenger brands in 2026, unless Suunto or Polar reenters the Wear OS market.

Challengers have no easy way to get widespread support for on-device payments (see the linked article for a workaround) and Spotify inside the watch, so you would have thought they would have to jump on the Wear OS wagon at some point in the next five years or be left a long way behind on the smart features they can offer. Countering that is the ringfencing of the latest versions of WearOS to Samsung and Google-only products.

Coros

This is speculative information

-

-

- Coros NOMAD – August 2025 – chunky adventure watch (like Garmin Instinct)

- Apex 4, October 2025

- Pace 4, November 2025

- Coros Arm Band 2 (Whoop-like), 2026

- Vertix 3 + 3 AMOLED, 2026

- Coros Dura 2, 2026

-

Coros’ next move should be to clearly position itself as an AMOLED-only watch company at its mass-market, lower-end, and MIP-only outdoor performance models. Vertix must continue the company’s tradition of market-leading battery life, as Garmin does, and offer solar or smaller-case variants.

I don’t foresee any new watch sub-brands created by Coros. Instead, a larger version of Pace 3 (like Garmin Enduro) or a smaller version of Vertix 2 makes more sense. This would follow a similar theme to what the company did with the Apex 2 Pro, successor to its smaller Apex 2 sibling.

Maybe we will see something completely different.

The Whoop market must tempt Coros to enter the 24/7 wearable band market. It will be easy for the company to make one, but it will be less easy for it to improve the app to the standard of Whoop.

The Coros DURA bike computer features a solar boost that complements its market-leading battery life. It’s not the prettiest bike computer (OK, it’s the ugliest), but it’s one of the easiest to operate, thanks to a Digital Crown on the side. I suspect it hasn’t sold well and won’t sell well in the future, even when ‘fixed.’ Perhaps the company won’t add Dura 2 in 2026. If so, where will new products come from? Coros will become another niche sports watch player trying to compete in the higher-priced tiers (like Suunto and Polar) – a strategy that won’t work for them in the medium-term despite current successes with a younger, emerging generation of runners.

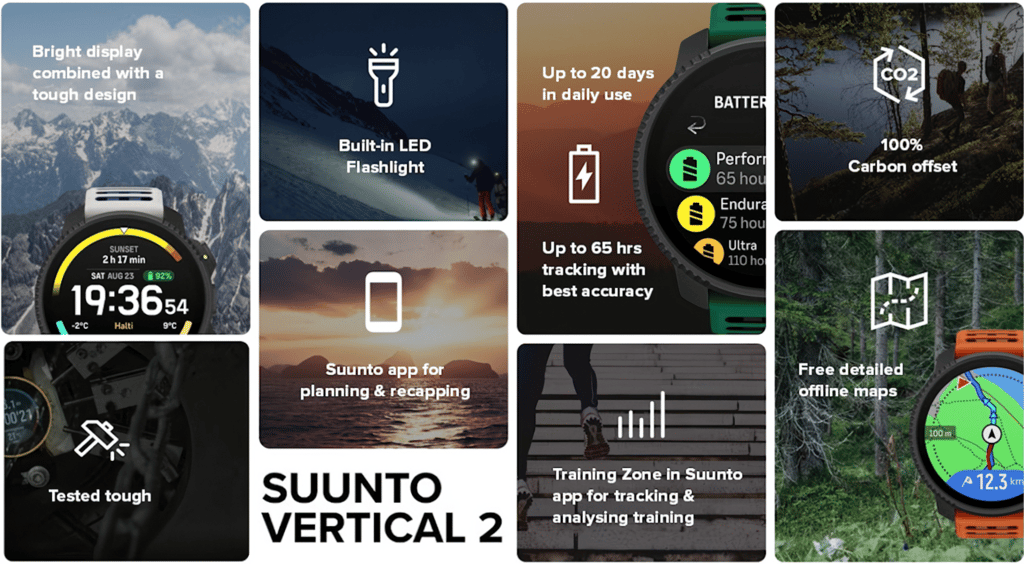

Suunto

Suunto is the most likely to surprise us at every turn, as evidenced in 2024 by the excellent Suunto RACE 2 and Suunto RUN watches (possibly the best outside of Garmin) and the Shokz-like Suunto Wing headphones. Suunto has also opened up its app to Xiaomi and Hammerhead.

Suunto’s new Chinese parent owns the Haylou watch brand. A dramatic cross-branding of Suunto watches could result in newer, more affordable models. Suunto RUN might indicate more of this to come.

Suunto Race 2/RUN features new internals and is not adopting the Wear OS route. They seem to have dialled in a future for their proprietary OS, and Suunto RUN is the first of a new hardware generation, the tech stack for the company’s future direction. Indeed, Run/Race(2) and Race S have been successful for the company; perhaps they will double down in that area with more iterations and variations.

This is speculative information

-

-

- ✔️New Suunto Vertical SOLAR, March 2024 (minor iteration replacing non-solar version from May 2023)

- ✔️New Suunto OCEAN

- ✔️ New Suunto Race S (larger Race was Q4.2023)

- ✔️ New Suunto Race 2, 27 Aug 2025

- ✔️ Suunto RUN – 13 May 2025

- ✔️ Suunto Vertical 2 – 30 Sep 2025

- Ocean 2 summer 2026 at the earliest, I suspect 2027

- Run 2, 2026

- Race 3/3s 2027

- Vertical 3 2027

-

Polar

This is speculative information

-

-

- ✔️ Vantage M3 (2024)

- ✔️A Polar LOOP (September 2025)

Pacer 2 AMOLED, 2 PRO AMOLED Q4.2024 – this was the Vantage M3- Unite, 2026??? – This line may be dropped or, more likely, rebranded

- ✔️ Grit X2 – June 2025

- Grit X3 – 2027

- Vantage V4 – 2026 – the new Polar hardware platform for 2026-2028?

-

Also next up from Polar mihttps://the5krunner.com/2025/09/29/who-owns-whom-in-sports-tech-is-that-comapny-chinese-a-comprehensive-list-of-wearables-electronics-platforms-bike-and-running-hardware/ght be AMOLED versions of the Pacer (Pro) and Unite (fitness) watches. It’s unclear if or how a next-gen Pacer can be differentiated from M3.

Polar is taking a similar but distinct route to Suunto by opening its platform to Sennheiser’s optical HR earbuds and licensing its algorithms (Motorola, Casio).

Wahoo

Wahoo released its entire third-generation line of bike computers in just 4 months in 2025. Aside from a mini or off-road model, I don’t expect any updates to the Ace 2, Bolt 4, or Roam 4 until 2027. Similarly, it also recently released TRACKR RADAR, KICKR RUN, and KICKR BIKE PRO.

Q: What does that leave for Wahoo to launch in 2026?

A: Not a lot on the bike computer front.

-

-

- Smart watch? A: No, that ship has sailed

- New accessories—Yes, we will likely see 2x TRACKR HRMs with higher-end features. Perhaps a front light to match TRACKR RADAR.

- I expect an improved CLIMB 2, HEADWIND2 and a KICKR MOVE 2 later in the year

- I hope that Wahoo has built on the pedal power meter tech it acquired from Speedplay and that we see Shimano and LOOK variants.

-

If we got all those, I’d be personally delighted.

Hammerhead

-

-

- ✔️ Karoo 3 (2024)

- Karoo 4 Q2.2026 (speculative)

-

A possibility would be a smaller-format Karoo 3, but this is unlikely given the Karoo 3’s battery life. Karoo 3 just about gets away with its battery life, but any less would be a difficult sell (like Edge 540/840). Assuming Karoo 3 has sold well for the brand, a new iteration would need to address battery life urgently, as competitors move ahead.

Apple

This is speculative information. 😉

-

-

- ✔️Apple Watch 12 – Sep 2026

- Ultra 4 versions are expected in 2026 (leak)

-

Apple Catastrophic Product Leak – Entire 2026 Range – Everything Revealed

Google will iterate on the Pixel Watch annually, incorporating Fitbit technology and sports-like features. The AI-personalised Health watch is destined for Fitbit premium users and offers Gemini-powered insights into fitness, sleep, and wellness.

![]()

Google initially said the Fitbit brand would continue only in software, but comments late in 2025 suggested hardware was coming in 2026. Likely H1.2026.

-

-

- August 20, 2025: Pixel Watch 4

- Fitbit/Versa – possibly early 2026

- August 2026: Pixel 5, 41mm and 45mm

-

I’m surprised that Google appears not to have a strategy for a more rugged Ultra watch (like Apple and Samsung). That said, if you look at Google search trend data, Samsung ranks much higher, so there may be no market for a Pixel Ultra at this stage.

Samsung

-

-

- Samsung Galaxy Watch 9 (Standard) – Q3.2026

- Samsung Galaxy Watch 9 (Ultra) – Q3.2026

-

2026 creates some interesting decision points for the brands

The era of companies quickly adopting technological leaps to expand sales in global markets has ended. An example is microLED, which has shown great promise, but first-gen displays are more of a step backwards than a step forward.

Significant advancements remain possible but are increasingly challenging to achieve, and the certainty of ongoing economic growth in Europe is gone. Supply chain disruptions (due to China sanctions) and increasingly regionalised/deglobalised markets will make smartwatch development more challenging than in years past.

-

-

- Garmin has filled all the major product niches and more. It seems to be aiming for annual refresh cycles of its key products and a strategy of swamping market segments with numerous product options, perhaps deliberately trying to confuse customers into asking “Which Garmin?” rather than “Which watch?”

- Regarding geographical expansion, can a US-Taiwan-based company (Garmin) improve market share in underperforming markets like China? Probably not.

- Polar still lacks a running track mode, and once admitted, it can’t compete with Garmin in a triathlon. Its web platform and app are undergoing a revamp. Polar LOOP might be the company’s best chance to move in a different direction, as a return to Wear OS is unlikely.

- Suunto seems to be moving in many right directions—aesthetics, quick lifecycles, and on-watch apps. Its Chinese owners can likely help the Suunto brand sell more in Asian markets and, in turn, build more confidence to expand beyond what we currently see with Haylou (part of the same group). It will need more than third-party watch faces from its app store or a Wear OS model to become a key player. It should compete against Garmin in areas where Garmin is poorer – like usability; rather than playing never-ending feature catch-up.

- Coros has done well commercially in the last few years. I can’t see how Coros’ newer, higher-priced models will help the company—it now competes directly with some Garmin models, and its ecosystem simply isn’t as good. It’s a small company with a good public profile and a generally loyal customer base.

- Wahoo has many technological avenues to explore to drive growth for its excellent product range, but the indoor bike training market is no longer the cash cow it once was. There’s probably little scope for Kickr Move 2 to differ materially from the current model. The company is refocusing its online training services, and the competition is red-hot at the lower end of the trainer market.

- Smaller bike computer companies like Sigma, Bryton, igSport, and Magene will continue to innovate as they catch up with the technology; most now offer surprisingly good products. Still, I can’t see them making much progress in their Western European or North American market shares. Magene and Amazfit are likely the ‘best of the rest’ in the bike and watch markets, respectively. Both have relatively good hardware and core features, but their ecosystems lack punch. Magene has a varied strategy: it manufactures equipment branded as Decathlon and some for Wahoo, but its bike computers are own-branded.

- Even lesser-known smartwatch and sports watch brands emanate from Southeast Asia and India. It would just take one of them to secure financial backing and acquire Polar, becoming a global player rather than a struggling regional player few in the West have heard of or trust.

-

Smart Fitness, Wear OS, WatchOS & Similar Smarts

As I’ve said for several years, the endgame is Apple’s watchOS vs Google/Samsung’s Wear OS vs Asian brands’ dominance in low prices (China/India). That endgame seems as clear in 2026 as it was five years ago, although Garmin continues to outperform my expectations.

Proprietary sports platforms like Garmin, Polar, Suunto, Wahoo, (Coros?) will still be here in 2030. But…how big will they be?

As ever, increasingly competent smartwatches will continue to eat into the traditional sports-watch customer base: the high-end Pixel 3, Apple Watch 11, Apple Watch SE 3, and Samsung Galaxy Watch. They improve year on year, but the ongoing growth in sports uptake among younger demographics gives many brands a lifeline as sports-specific watches.

The Wear OS derailment is now back on track. Samsung and Google get first pick with the latest versions of Wear OS before competitors. They have decided to ringfence the entire market, and third-party alternatives from years past will become increasingly rare, along with dated Wear OS versions.

Something significant needs to happen to disrupt markets and change the medium-term trajectory, such as a war over Taiwan, an AI god taking over the world (!), the EU forcing Apple to open up iMessage to a standard API, or a stock market crash and recession. Without such disruptions, the inevitable trajectory is the Apple vs. Google/Samsung stand-off.

Huami (Amazfit/Zepp), Huawei, Realme, Redmi, TicWatch, and others will continue the battle for budget smartwatches. The endgame is “Who makes the best do-it-all $150 commodity watch?” Several of these have significant sales figures in some Far Eastern markets, and some products might even be described as increasingly competent – e.g. T-Rex 3. Indeed, we now see Chinese companies building significant competencies and sales volumes in their domestic markets before using that strength in other geographic markets; ‘dumping’ is an issue in non-smartwatch markets (EVs, solar panels); maybe that will also happen to smart tech. That will be a major disruptor of value brands and value models.

Many companies cannot effectively cross-sell smartwatches without a top-tier smartphone from the same brand. Even those with a decent partner smartphone, such as Huawei, face other political issues.

Bike Computers – Hope or Hopeless?

Garmin dominates this sector, with Wahoo as the leading challenger brand. The long-term impact of SRAM/Hammerhead Karoo 3 remains uncertain, but it is viewed as a hopeful contender with realistic success potential. Lower-end brands, such as Lezyne or budget, high-spec options like Bryton (Taiwan)/Magene (China), Mio Cyclo (MiTAC, Taiwan), Navihood, TRIMM, CYCPLUS and iGPSPORT (Korea) appear to face challenges to get even the smallest of footholds in non-Asian markets

Wahoo, adept at maintaining secrecy, is not expected to leak information. With three sizes of performance satnavs, Wahoo now covers most commercial bases in the bike computer market. Apart from iterative model strategies, there are no significantly new gaps for it to exploit there. Where else can it look?

While Apple, Google, and potentially Asian players in domestic markets may dominate the global watch market, Garmin indisputably leads the bike computers. Many challengers exist to Garmin’s Edge Series, but only Wahoo & SRAM-Hammerhead seem to be coherent challengers with decent marketing and tech combos. Whilst they lack in the feature count stakes, they are catching up, but catching up is difficult. But Bolt 3 and Roam 3 have been given a lifeline by Edge 550/850, and their poor battery life.

Garmin’s market position is interesting to debate, as Garmin Edge will NOT pull further ahead regarding features or market share. Their tech is already well-advanced, and their market position is too dominant. They can’t improve! Catching up in each respect is more straightforward than for Garmin to pull further ahead.

Smaller companies face a challenging task in getting close to Garmin in cycling. The likelihood of a new product eventually outperforming Garmin is higher if it’s Android-based, owing to the potential advantages of easier app integration and a shorter development cycle, as seen with the Karoo. Stages seemed interested in this competition with its DASH L200/M200. Still, its bankruptcy has dealt a fatal blow to the DASH models, and it is unlikely that the new owner, Giant, will pursue bike computer development in any way but tokenistically…if at all (see: Planet 9). For starters, the old Stages bike computers would need a design overhaul from the ground up.

Garmin’s focus on higher price points leaves plenty of room for smaller companies like Bryton, Sigma, Lezyne, iGSport and CatEye to compete in the lower-priced, less profitable arena. Ancient rumours about Polar releasing a bike computer are wishful thinking. Phones are increasingly used as recreational bike computers, and they do a good job at it – Apple has already covered this base.

While well-featured bike computers like Stages M200/L200, Sigma ROX 12 EVO, and high-end Bryton models exist, they seem to lack the unique appeal that propels them to Wahoo’s level. Wahoo BOLT Gen 1‘s enduring success beyond its fourth birthday suggests that many riders prioritise reliability, user-friendliness, or brand image over high technology.

That’s all.

Further Sources: Lists of all Firmware Updates

-

-

- Suunto updates are here: link to Suunto.com

- Polar updates are here: link to Polar.com

- Garmin updates are here: link to gpsinformation.net

- Elemnt Updates are here: link to wahoofitness.com and here

- Fitbit updates are here: link to Fitbit.com

- Hammerhead Karoo is here: link to Hammerhead.io

- Lezyne is here: link to Lezyne.com

- WatchOS 5 is here: link to Apple.com

- WatchOS 6 is here: link to Apple.com

- WatchOS 7 is here: link to Apple.com

- WatchOS 8 is here: link to apple.com

- WatchOS 9 is here: link to apple.com

- WatchOS 10 is here: link to apple.com

- WatchOS 11 is here: link to apple.com

- WatchOS 26 is here: link to apple.com

- Stages DASH is here: stagesdash.com

- Sigma Rox 12.1 here: sigmasport.com

- Mio Cyclo: mio.com

- Coros: link to Coros

- Bryton: Facebook page for announcements

- Magene: magene.com

- iGPSPORT: igpsport.com

- Coospo: coospo.com

-

Please let me know if I’ve missed anything, like the Pixel Watch!

It is also helpful for checking compatibility with new ANT+ devices. Occasionally, a special ‘leak’ might appear on that site by accident. As of Q1.2025, Garmin is rolling back support for ANT+, so expect this site to eventually stop being updated.

-

-

- thisisant.com

- ANT+ Specification updates here: thisisant.com

-

Subscriber-Only Content

The following link discusses emerging trends, including payments, dual-band GPS (aka dual-frequency GNSS), OHR, Safety, Mapping, and more.

Recommended Reading: Endurance Technology Trends

END, thank you for your support. This takes considerable time, and we appreciate any support you can provide.

Last Updated on 15 February 2026 by the5krunner

tfk is the founder and author of the5krunner, an independent endurance sports technology publication. With 20 years of hands-on testing of GPS watches and wearables, and competing in triathlons at an international age-group level, tfk provides in-depth expert analysis of fitness technology for serious athletes and endurance sport competitors.

“I’m struggling to see the next big thing in bike computer tech… Bike computers seem to do all they need to.”

I’m struggling to agree with that!

I would like to see some functionality for cyclists that matches or exceeds what Garmin is already offering to runners:

1. 4G integration covering at least LiveTrack and text or WhatsApp messaging. This is a great value proposition as it would allow many people to leave their phones at home, saving weight and feeling more free. (Or a backup to a phone for solo tours.)

2. A replacement for the ageing 1040 Solar, for those who need the battery life more than the pretty screen (e.g. the ultra distance niche), and otherwise feature equivalent to the transmissive screen version.

3. Satellite messaging

4. An integrated light (a ‘to be seen’ one)

5. An integrated camera (not as capable as external cameras but capable of automatically taking stills on deceleration)

Items 1 and 2 are a higher priority for me than a replacement for the 1050/850, which I agree with you, are hard to improve upon for the average cyclist (except perhaps in usability and visual design) and still feel very new. It’s the niches though which are Garmin’s historic strength. And these niches often become mainstream, making Garmin money. I hope they’re not abandoning that strategy and becoming like Apple.

thanks George

I meant BIGGER than those 😉

1. 4g/5g…yes agreed its a needed evolution, ultiamtely i want to leave my phone at home.

2. yes i think i covered that? ah i see…you mean an update with a battery life!!! 😉

3. hmm. one day.

4. sort of agree. My Ravemen light (is a light) but also a battery charger for the garmin/wahoo. you’re adding another reason to deplete teh battery, albeit a nice to have for safety in some circumstances. my old polar bike computer had an led on it. maybe someone will add one as people love them on the watches???

5. i dont think that will happen as tech changes too quickly. i had an xplava bike computer who camera become too dated too quickly.

nicehes – no. i doubt garmin will abandon that strategy. as you rightly point out its made them billions.

What updates do you expect the spring refresh of the Varia base model to have?

I am hoping at least USB-C connector and hopefully improved battery life.

I think a user replaceable battery would be amazing, but am doubtful to see that.

usb-c would be a legal requirement.

like you i would want better battery but even wahoo struggled to improve the battery much on their radar light a few months back.

i cant recall all the fals modes from emory but i would expect those to be in sync with what others offer. particularly perhaps also a brake light mode.

none of that is very exciting and might be why it’s not updated at all. garmin needs to find a way to get higher prices (like the 715).

I am not ready to wait for Enduro 4 for sooooo many years!

Cheers,

Yoda 😉

Okay, the quiz did not work, so it is the direct reason: there is a typo, 2206 for E4.

ty